Find out everything you need to know about the Locked-in Retirement Account (LIRA).

12 Minute read

Originally published: April 5, 2022

Updated: June 26, 2023

Find out everything you need to know about the Locked-in Retirement Account (LIRA).

12 Minute read

Originally published: April 5, 2022

Updated: June 26, 2023

Welcome to our guide on Locked-in Retirement Accounts (LIRA) in Ontario! Whether you’re planning for retirement or just curious about different investment options, we will cover everything that you need to know about LIRA’s. LIRA’s are great accounts to help you maintain your previous jobs pension or a pension plan from a former spouse, they can be used to invest to add more income to your pension, but the main catch is that they are locked up until you retire and convert it to a Life Income Fund (LIF), a Locked-in Retirement Income Fund (LRIF) or an annuity. Though there are rare cases of being able to unlock your LIRA, there are also other rules surrounding a LIRA. We will cover the pros and cons, how a LIRA works, and also how the LIRA compares to the Registered Retirement Savings Plan (RRSP).

In this article:

The locked-in retirement account (LIRA) is a type of registered retirement savings plan (RRSP) that holds money transferred from a pension plan from a former employer of yours, from your ex-spouse, or a surviving spouse. It is designed to provide individuals with a way to save for retirement while preserving the funds accumulated in a former employer’s pension plan. The funds in the account remain locked until your retirement, and must be transferred into a life income fund (LIF), a locked-in retirement income fund (LRIF), or the LIRA funds can be used to purchase an annuity to be accessed. You will then receive payments throughout your life when you are retired. The rules regarding LIRA accounts are regulated by the government and vary from province to province. This level of control and flexibility is essential for long-term financial planning and ensuring a comfortable retirement.

A life income fund (LIF) is a type of registered retirement income fund (RRIF) that can be used to hold locked-in pension funds and other assets for eventual payout as retirement income in Canada. A lump sum withdrawal from a life income fund is not possible. The fund’s owners must use it in a way that ensures retirement income for the rest of their lives. The minimum and maximum withdrawal amounts for RRIFs, which include LIFs, are specified in the Income Tax Act each year. If you worked for a company with an employer pension plan and were eligible to receive your pension funds before your retirement, those funds would have been “locked-in” under provincial pension legislation and would not be available in cash until you reached the retirement age specified in that province’s pension legislation.The money was put into a Locked-In Retirement Account (LIRA). A LIRA can be converted to a LIF once you reach normal retirement age. One of the benefits of a LIF is the potential for investment growth. Unlike other retirement income options, such as an annuity, a LIF allows you to keep your funds invested in a variety of assets, such as stocks, bonds, and mutual funds.

LIFs and LRIFs are tax-advantaged accounts that pay out the accumulated value of a locked-in RRSP, a locked-in retirement account (LIRA), or locked-in amounts under a registered pension plan (RPP). This money, unlike the money you put into your personal RRSP, must be used to fund your retirement. These accounts are intended to provide a long-term source of income. However, there are some limitations. You won’t be able to cash out your LIF or LRIF in most cases. The government establishes a minimum and maximum amount of money you can receive from your LIF or LRIF each year. You can, however, control your investment options and payment amounts within this range. One of the benefits of a LRIF is the potential for tax savings. By keeping your funds in a LRIF, you can defer paying taxes on the income until you actually withdraw it.

Two major differences between LIF and LRIF accounts are:

With a LIF, retirees have more control over how their funds are invested, as well as how much income they receive each year. LRIFs, on the other hand, often have more restrictions on how the funds can be invested and how much income can be withdrawn each year.

Typically, a Locked-in Retirement Account works when you leave a job that had a pension plan, or funds may have been split from a divorce, and your funds might have been transferred into a Locked-in Retirement Account so that you do not have access to it until you are retired. This account can also be made at your discretion if you want, so that the money is tucked away safely for when you retire. To access these funds, you will first need to be retired, then you will need to transfer the funds into a Life Income Fund (LIF), an annuity, or a a Locked-in retirement income fund (LRIF).

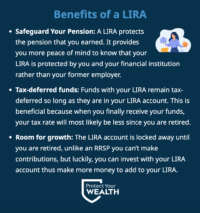

Makes saving easier for people who might be tempted to use their pension funds earlier than they should

Safeguards the pension that you are entitled to. You have control over your funds, rather than a former employer.

Eliminates the risk of losing your pension in the event that your former employer goes out of business.

Possibility to invest with your LIRA fundsRegulations vary from province to province, this can make it difficult to complete understand the rules surrounding your LIRA

Strict restrictions on withdrawals prior to retirement Limited contribution roomTo unlock a LIRA in Ontario there are specific rules and regulations that apply that you must follow, these rules differ province to province so if you’re reading this blog and not from Ontario please take a look at the rules regarding the LIRA in your province.

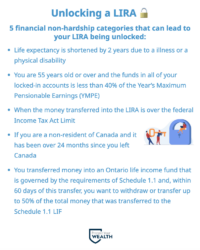

In Ontario, there are five financial non-hardship categories that are considered when unlocking your LIRA. These are the following categories that are considered:

Non-residents of Canada can unlock their locked-in account, but they may need to meet specific criteria and follow specific procedures. The process for unlocking a locked-in account for a non-resident of Canada may vary depending on the specific circumstances and the financial institution holding the account. In general, it may require proof of non-residency and a written request to the financial institution.

There may be penalties for unlocking a locked-in account for a non-resident of Canada, depending on the specific circumstances and the financial institution holding the account. It is important to carefully consider the terms and conditions of the account before making any changes.

Yes, there may be tax implications for unlocking a locked-in account for a non-resident of Canada. Non-residents of Canada may be subject to Canadian income tax on their Canadian-source income, including withdrawals from a locked-in account. It is important to consult a professional for guidance on the specific tax implications.

There are other reasons that you may also be able to unlock your Locked-in Retirement Account in Ontario. These reasons have to do with financial hardships you might encounter if you don’t access your LIRA. Here are the financial hardships categories that will allow you to unlock your LIRA Ontario:

Remember to be aware of the laws and regulation regarding LIRA legislation in your province, and always reach out to an expert financial advisor to find out what is best suited for your financial situation and plan.

Many people have had a great group pension job at the job that they have recently left, now luckily with a LIRA you can transfer your group pension. There are just a couple of important step that you must follow in Canada in order to ensure you transfer your group pension properly.

By transferring funds from your former employer’s pension plan to your new employer’s pension plan in an amount equal to the actuarial value of the benefits earned in relation to your pensionable service credits, you can increase your pension assets through a pension transfer agreement (PTA).

You might be able to transfer your pensionable service credit to your new pension plan when you leave one employer and start working for another while also enrolling in their pension plan. One way to carry out such a transfer is with a PTA. A PTA must have been signed between the Government of Canada and an outside employer in order for either party to take part in such an arrangement.

If your former employer is not one of the organisations with whom a PTA is listed, then the PTA may not be a legally binding contract. You must get in touch with your former employer to see if they are interested in negotiating a PTA with the Government of Canada if there is no agreement in place and you want to pursue the PTA option. You might want to look into the possibility of a Service buyback package as an alternative to a PTA (also known as elective service).

In order to increase your amount of pensionable service under the federal public service pension plan, you may enter into a legally binding agreement known as a service buyback. It might also cover any prior time spent working for the federal government or any pensionable employment with another employer.

There are plenty of options out there if you are leaving your job which has a pension with OMERS, this transfer can be done and these are your options:

Regardless of your circumstance and the direction that you want to go, our financial advisors will be happy to help you throughout this difficult process!

There are three options available to you if you decide to leave your HOOPP employer before your pension has started:

Once you know that you are eligible to switch your pension out and meet all the requirements remember:

You must be 71 years old or younger to unlock a LIRA account, but to open a LIRA account you must have an employee-sponsored pension from a former employer. If you have an employee-sponsored pension from a former employer you can decide to let them hold your pension until your retire, or you can transfer the pension to a LIRA account and safeguard it with a financial institution and use it in some cases, or invest the amount in the fund with the help of a financial planner. You are also eligible to have a LIRA account if you have a pension plan set up with your former spouse or a deceased spouse. Additionally, there may be restrictions on the amount of funds that can be withdrawn each year, as well as limitations on how the funds can be invested.